When starting a franchise business, you’re given far more resources than the typical entrepreneur.

First, you’re using a proven business model built by your franchisor. This usually includes marketing materials, hiring processes and – of course – a product that customers love.

But there’s one constant that remains across any business: accounting. In this article, we’ll cover the importance of having a separate business account and what to look for in a provider.

The benefits of having a separate business account

When starting out, many new entrepreneurs want to keep things as simple as possible. Using their personal bank account instead of a business account is one way they choose to do this.

However, this approach makes bookkeeping and tracking expenses more time-consuming. Having a separate business account will actually make your business and accounts much easier to manage.

Here are a few other reasons you should open a separate business account:

- Accounting: With business and personal transactions kept separate, keeping on top of your accounting is much easier. It will also help you follow HMRC’s rules and requirements

- Credit: Many banks will only give out loans to businesses with a dedicated business account

- Rules and regulations: Some consumer banks have stopped allowing people to use their personal account for business transactions

Having a separate account will also help you keep track of initial and ongoing royalty fees paid to your franchisor.

If you’ve already started your business journey using your personal account, consider opening a separate business account when:

- Tracking and reporting become too complex: If you’re struggling to differentiate and keep track of business transactions, you should consider opening a dedicated account

- You’d like to accept credit card payments: When accepting payments online, you can either open a merchant account or use an alternative gateway to accept credit card payments. If you associate those payments with your personal account, be aware of the risks.

- You’re processing too many transactions: As your franchise business begins to grow, the number of transactions you process may increase. Opening a business account before this happens will avoid headaches later on.

If you’re starting a franchise business under a limited company, then you’ll be required to open a business account by law.

What to look for in a business account

So, you’re ready to open a separate account for your business. What should you look for in potential suppliers?

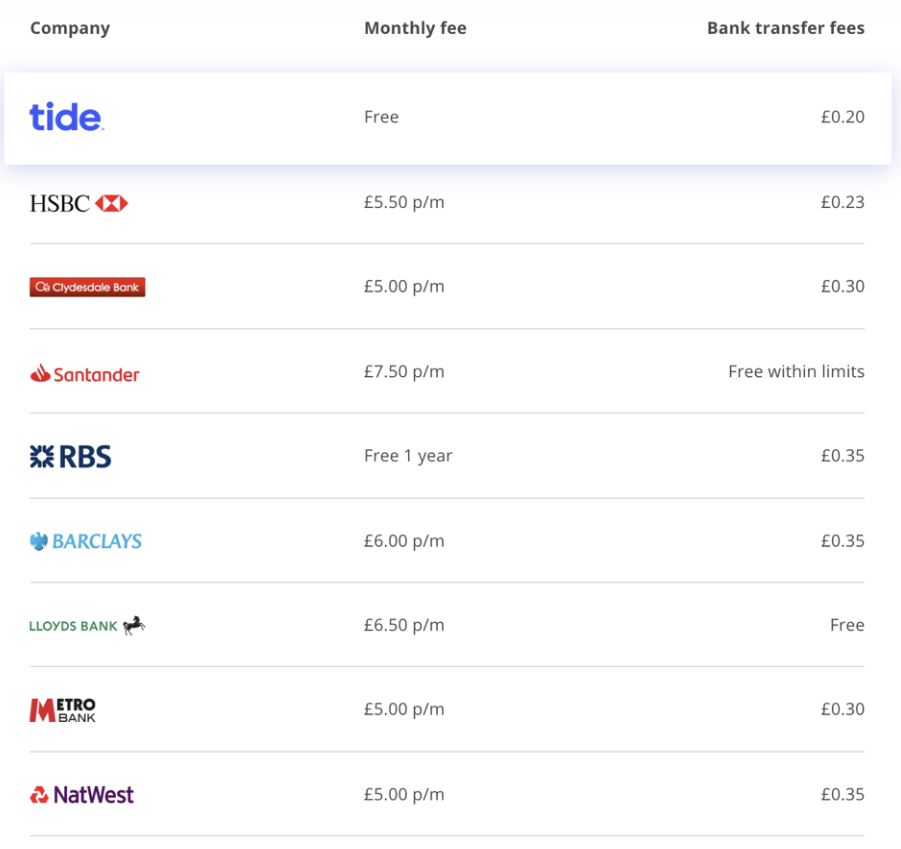

Every bank has its own pricing, fee structure and benefits. For example, many high street banks will not only charge you a fee for every transaction, but a monthly fee on top of that.

When considering options for your business current account, seek out answers to the following questions:

- How quick and easy is it to open an account?

- Are any face-to-face interviews required?

- What are the fee structures?

Opening a business account used to be laborious. Now, thanks to new technology, you can open an account in minutes. Therefore, you should find out if you’ll be required to go into a branch to open an account.

You should also watch out for limited offers and fees. Some banks may offer zero monthly fees for a limited time, but you’ll have to pay them once that period is over.

Find a provider that doesn’t make you jump through hoops and hurdles. Look for simple and transparent pricing structures that clearly illustrate the benefits you get for the fees you pay. We’ve made a comparison table to help you with this:

To open a business current account, you’ll need the following documentation:

- Proof of identity: This could be a driver’s licence or passport

- Proof of address: Again, a driver’s licence or passport will do the trick. However, some providers may ask you for a utility bill as secondary proof

- Companies house registration number

You’ll also need details about all company directors, as well as your turnover to date (if applicable). In order to open an account in the UK, you must also meet the following criteria:

- Have a clearly defined ownership structure (number of directors, names etc.)

- Have an annual turnover of less than £6.5 million

- Be based in the UK

Remember, look for a provider who has your best interests at heart. If they ask you to jump through hoops, consider other options. In today’s competitive landscape, there are plenty of them.

Ready to start your franchise business? Get started by opening a business account today! (QFA members get £50 on us and a year of free transfers.)

Find Out More

About the author – Kerstin Reichert

Kerstin is an experienced marketeer and Digital Marketing Manager at Tide.

She is passionate about sharing her startup and marketing experience to help small business owners get started and grow their business. She has been teaching various seminars and workshops over many years and is a leading instructor for Linkedin’s e-learning platform Linkedin Learning.

About Tide

Tide is revolutionising how small businesses manage their money admin. Since 2015, we’ve been designing a service from the ground up that takes the stress and paperwork out of business admin. Our mission is to create the ultimate platform for entrepreneurs and small business owners, helping them to focus on building their businesses into something great, giving them back the time to do what they love.